Our Next 50%+ Winner In Global Seaborne Transportation is Here--In Global Shippers We Trust!

Hey Subscriber,

Ok sports fans--we have teed up another 50%+ annual return with the MOST amazing seaborne shipper we have ever found and we have PATIENTLY waited to add to our Ultra Income portfolio (we have TRADED this amazing company a few times in the All Access room).

PS--I always love it when the Wall Street Journal posts an article like today declaring "Transport Stocks Flash Good Sign" after we have scored such amazing returns in the last 3 months of $SBLK $FLNG $GOGL (lame headline I admit.)

However, while I have been super impressed with $ZIM Shipping as a business model AND when they declared a $17 dividend for Q4 2021 AND when the CEO came out and said the $ZIM dividend game plan from now on was now "variable" --my new favorite term--and that they would be paying out 50% of their now insane level of cash flow as a regular (not special) dividend, I was skeptical about how this dividend would play out in the real world.

Well we know now--when $ZIM closed at $88.50 on the day before the $17 per share stock dividend went ex-dividend, we bought a small put option position in ZIM just in case it sold off--and it did.

It sold off down to $74 and then held its key support at $68.50 while we waited patiently.

What happened? Well, my best guess is a whole bunch of day traders piled in ABOVE $80 for the $17 dividend BEFORE the ex-dividend date of 3.22 and dividend date of record on 3.23. Because the $17 was not designated a "special dividend" but a 'regular dividend, they assumed it would trade down a bit but not retrace the $17 dividend.

THEN--we ZIM did pull back $12, they either sold or had market order sell stops hit.

So how do we get our $17 per quarter cake and eat it too?

First, you have to understand ZIM management is committed to paying out 50% of its quarterly cash flow.

Second, you have to understand that because the day rate for container ships has exploded in the last 12 months, and supply chain issues are still WAY behind for EVERYONE through Q2 2023 at best, there are FAR TOO MANY shippers chasing far TOO LESS shipping container boats.

This demand vs. supply mismatch happened simply because the pandemic turned the major global economies from 70% service economies to 50%+ GOODS economies as anyone with discretionary money around the world moved to an unprecedented high percent of our discretionary spending to STUFF from services--and the global logistics systems were (and still are) overwhelmed.

How overwhelmed?

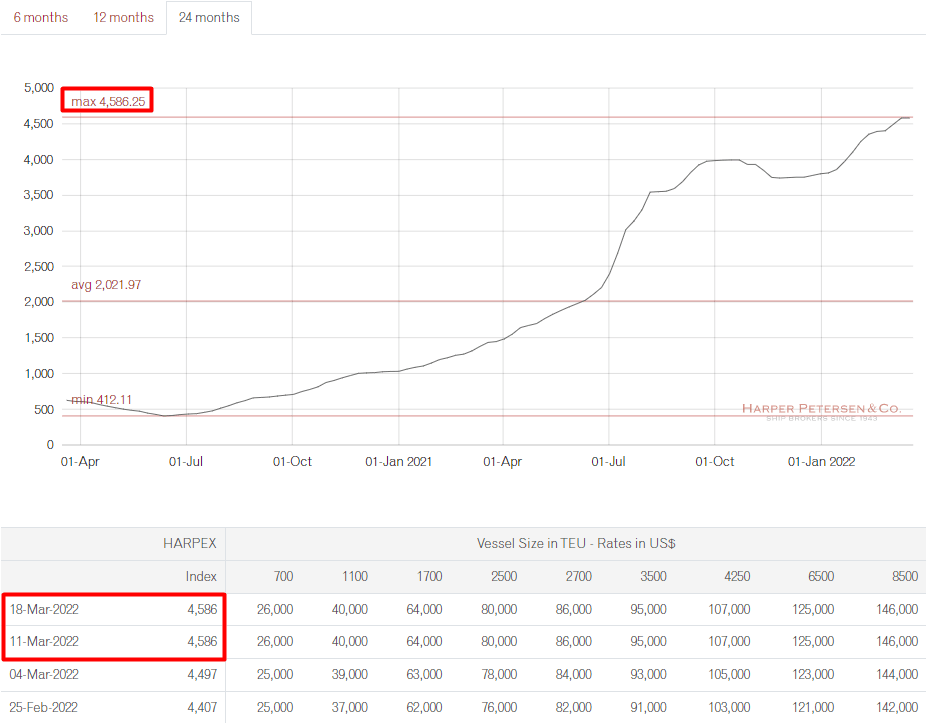

Here is the latest Harper Index and day rate index for shipping containers and container ships (with EVERY container and EVERY ship leased up through Q2 2023:

Click here for the latest Haper Index as of today--its even higher!

Isreal based $ZIM is the ONLY container ship line with the lowest cost per day operating boats in the world. The environmental regulations for shippers' carbon emissions really kicked in ironically at the time intermodal shipping demand exploded in late 2020. $ZIM is the ONLY container ship line that runs on--wait for it--LNG!

And BECAUSE $ZIM container ships run with so much LESS Carbon pollution, they get to run at 25%+higher SPEEDS than the old bulk diesel container ships (the other container boats are MONITORED via satellite for the speed they are traveling to comply with relatively recent environmental laws).

Key Point: ZIM's competitive advantage is STAGGERING--because the MORE speed for your boat means fewer days at sea and thus greater profit for the companies that lease the $ZIM boats or lower shipping costs for the OEM players like Walmart or Amazon that lease their own container ship fleets.

And to top this amazing story off, 100% of the $ZIM boats are leased for 2022 at the above historic rates, $ZIM the public company trades at the insanely low valuation of EV/EBITDA of < 1x and a P/E of < 2x, ZIM's current valuation is severely undervalued relative to the competition (and that is before we value the advantages of their low-cost LNG fuel and faster waterborne travel speeds to end clients).

On this basis alone, I expect ZIM to gain another 30%-40% after this recent dividend payout. Also, given that today's hot market is likely to last at least until the end of 2022, we can USE in-the-money put options to create enormous profits going into the next quarterly $17 dividend payment based on the 50% of cash flow payout rate.

Finally, with the prices of goods produced in the modern world rising with runaway production cost inflation, we should expect the WalMarts and Amazons of the world to INCREASE imports purely to protect their margins.

Buy Under Advice: $ZIM up to $77 with a $105 target 2023

Dividend Hedging Plan: We will send put option advice as we get closer to the next dividend date soon to be specified by $ZIM management.

Isreal Dividend Holding Exemption: If you are paying taxes on your dividends, any dividend withholding is deductible dollar for dollar. You have to hand it to the Israeli government--they make sure they get their income taxes! You have to file a simple form to get the 25% withholding back...I have done this before with Israeli companies and it's a very fast and painless service.

ZIM's Agent Contact Information: ESOP Management & Trust Services Ltd. Tel No: +972-3-753-6823 Fax No: +972-3-760-2636 Email: esop-helpdesk@esop.co.il Investor Relations: Elana Holzman ZIM Integrated Shipping Services Ltd. +972-4-865-2300 holzman.elana@zim.com.

Final REALLY Important Issue: The war in Ukraine is upending the global shipping industry, which is still trying of course to simply recover from the coronavirus pandemic. Ocean rates could even double or triple from the current $10,000 per 40-foot container, according to Glenn Koepke of supply chain consultancy firm FourKites.

Ripple effect: Cargo checks are now one of the biggest disruptions to shippers, making sure they are not breaking sanctions at ports in the EU and the U.K. Staffing problems: Russian and Ukrainian seafarers make up 1 in 7 of the world's shipping workforce, per the International Chamber of Shipping. These essential workers are not easily replaceable, while airspace bans have compounded issues by making it harder to ferry personnel to and from ports. Ship movements in the Black Sea, a key commodity export route, have also been frozen since Russia's invasion of Ukraine, and staffing those ports will be a key security concern even if they open in the near future.

Net Effect: We should expect HIGHER container shipping rates for a LONGER period as all the above backs up both bulk shipping and container shipping for many months AFTER Black Sea hostilities hopefully calm down.

In inflationary times, in shippers we trust!

Go get 'em!

Toby