UPDATED VERSION: How We Will Make Another 100%+ Upside With Our REXIT Trades 2.0

Well, Vladdy Putin, You Just Changed our Six Month Macroeconomic Assumptions and Our 70%+Profitable Q1-Q2 REXIT Trade Is Back On With Even HIGHER POTENTIAL $Returns For Q3-Q4 and into 2023!

Dear Subscriber,

We are still 93% in cash and are ready to deploy a LOT of our cash into a "REXIT Reload" trade...more details and portfolio picks out tomorrow.

Key point: My old tech/spreadsheet nerd friend Scott Shaffer is REBUILDING our Ultra Income+ Growth and Ultra Growth + Income spreadsheets and closing out the positions from March 15 in Ultra Growth (any that were left) and June 10 sales in Ultra Income.

When he is done, we will load in our REXIT Reload picks with buy under and chart links and ALL kinds of cool stuff--Scott promises me!

OK, now let's get to our 2H 2022 Update.

Yes, the Q3 EPS and Guidance Palooza is about to start tomorrow--but the first consumer inflation impact on EPS guidance came from Walmart tonight. And I quote the CEO Doug McMillon

“Food inflation is double digits and higher than at the end of Q1,” the company stated in a release. “This is affecting customers’ ability to spend on general merchandise categories and requiring more markdowns to move through the inventory, particularly apparel.”

Really? What a surprise :)

“The increasing levels of food and fuel inflation are affecting how customers spend, and while we’ve made good progress clearing hard-line categories, apparel in Walmart U.S. (their highest profit items) is requiring more markdown dollars. We’re now anticipating more pressure on general merchandise in the back half,” Chief Executive Doug McMillon said in a statement.

The shares of Walmart Inc. sank more than 8% in after-hours trading today after the retail giant lowered its profit forecast, disclosing that inflation has required the company to conduct more markdowns.

Key Point: Walmart executives now expect adjusted earnings per share to fall by 8% to 9% for the fiscal second quarter and 11% to 13% for the full year. Walmart’s prior forecast called for earnings per share to be flat to up slightly during the second quarter and down 1% for the full year.

This is exactly what I talked about in our last update--Fed rate increase-based recessions always follow the same pattern (and of course, we have never EVER had Fed rate hikes while also suffering from a 1) global energy price crisis plus 2) Synchronous Global Central Bank tightening and 3) $1 trillion a year drained out of the US monetary system--but I digress ):

First, when the 10-year bond interest rates rose to 3.5% from 1.25%, the denominator in the market P/E valuation (aka discounted present value of future EPS) came down from 23-34X forward earnings estimates to 16-17X--that is called the P/E value compression phase of a bear market--and the massive Q1-Q2 market values drops did the heavy lifting to reduce market p/e's with the Nasdaq 100 down 35% into mid-June and SP 500 down 24%.

But tonight, Walmart waltzed us into the "earnings recession estimates" phase of further stock value compression with EPS down 11-13 percent for the full year. That 11-13% lower EPS just shaved $38 billion off WMT market cap tonight--not really the way you want to START the EPS re-rating parade for the second half of 2022.

An 11-13% earnings recession in the last half of 2022 of the largest retailer in the world seems like the poster child for the next phase of the bear market-- the earnings/EPS recession and equity value rerating phase.

Here are the most important earnings palooza players this week (PS: Whirpool, the appliance maker and pandemic beneficiary, also slashed its 2H 2022 guidance tonight, reported mixed second-quarter earnings, and slashed its guidance for the year, saying the results came amid a “challenging environment” with rising costs and a demand slowdown.)

You seeing a pattern ex-the-REXIT energy beneficiaries yet?

Key Point: Roughly 35% of the S&P 500 and 54% of the Nasdaq 100 market cap, 175 companies will report this week In addition to Apple/Microsoft/Amazon/Apple/GOOGL, Dow components reporting include Coca-Cola Co. KO, 3M Co. MMM, McDonald’s Corp. MCD and Visa Inc. V on Tuesday; Boeing Co. BA on Wednesday; Honeywell Intl. Inc. HON, Intel Corp. INTC and Merck & Co. Inc. MRK on Thursday; and Chevron Corp. CVX, Exxon Mobil and Procter & Gamble Co. PG wrap up the week on Friday.

By the end of this week, the market (and us) will know enough to judge approximately

1) How large will the "earnings recession" actually be for SP 500 companies (again Q1-2 gave us the P/E evaluation compression--now we need to know what the forward "E" aka EPS or earnings per share look like for 2H of 2022)

2) How brutal is the record high dollar valuation on repatriated earnings for multinationals, especially global mega-tech companies

3) How much of the 9.3% price inflation and 50% higher diesel + transportation costs could companies pass through to consumers?

4) How much did #2 and #3 lower gross margins?

ALL the above STILL makes a strong base macro case for an extended period of stagflation that everyone does not want to hear. Remember the 25-35% increase in YOY shelter costs 2021-2022 go into the PCE inflation index with a 6-9 month lag--don't ask me why!). The weighted shelter data takes up 32.77% of CPI, of which 7.8% is rent and 23.68% is privately owned housing

Plus, we all know that Europe is crushed by energy cost inflation, and a European recession (like the US) is already happening--we just didn't know how badly Mr. Putin's ego has been damaged and how badly he now wants to punish his neighbors and NATO for standing with Ukraine.

Until today--more on Putin's NORD 1 80% cut of Russian natural gas delivery to Europe tomorrow--but with NO END IN SITE for the Ukrainian war, and no end to the Russian war atrocities in Ukraine, even if Russia "wins" some territory in a stalemate, as long at Putin is alive he will punish the EU for supporting his sworn enemy.

The Fed Pivot Narrative?

The big macro question in the money management and Wall Street world is "When Does the Fed--After Crushing US GDP Growth from Growth to Recession--"PIVOT" and start CUTTING Rates to Ride in and Rescue the US Economy?"

Here are some of the best guesses I have collected--and then I'll get to mine after this week is over and the data is clear-cut. Much of the debate I read and hear is focused on whether a downturn will start this year or 2023.

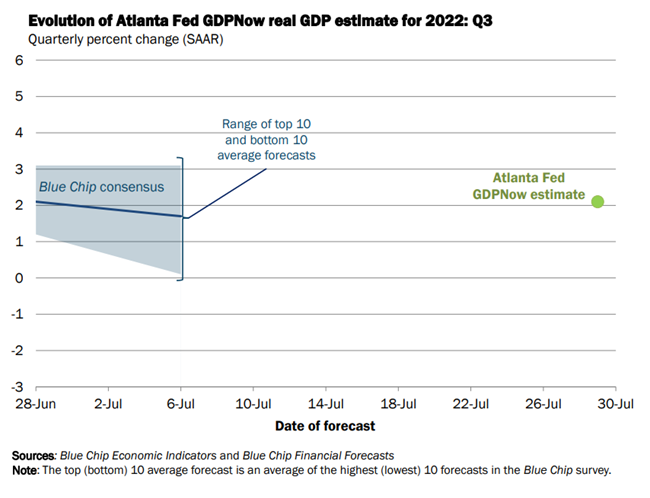

Again our Macro Market Index and the Atlanta Fed's GDP Now Index say the US is already in a technical recession (2 back-to-back quarters of negative GDP)--and WalMart's recession data to both indexes.

The EU is without a doubt in a serious recession (led by Germany) given the 15% natural gas demand reduction plan from the European Union leaders.

The GDP Conundrum: Good GDP news would be BAD for US stocks ex-REXIT beneficiaries.

Why? Because even a shallow recession could cost over a million US jobs. That magnitude of job loss would help ease the biggest inflation outbreak in decades, and in theory, get the Fed rate hikes to end more quickly.

The"Fed Pivot" narrative, in theory, would have the Fed riding in to rescue the economy with rate cuts in Q4 2022 or Q1 2023. The sudden reduction of Fed Fund rates (and rejoicing the monetary system with QE) is seen to avoid a more-severe recession that really smacks corporate profits down hard, sees millions of jobs go poof, and of course, brings a sharp bigger sell-off for the S&P 500 stocks (and sends many more $trillions to money heaven which is the definition of GDP crushing "negative wealth effect the Fed so lustily wants to avoid

Yet under any economic scenario, inflation fears won't subside without a LOT more pain from the Fed. The unemployment rate is bound to rise. That could come abruptly or last into 2024 as the Fed's VERY LOW-probability "soft-landing" projections envision.

Key point: We need to be realistic about prospects for a sustainable near-term rally--and until the "data dependent Fed" sees enough deflation, Federal Reserve policymakers are unlikely to grant a stock market reprieve, BCA Research chief equity strategist Irene Tunkel me in a recent webinar.

Thus Rule #1 of a Fed-Based Bear Market: All 10% rallies should be SOLD until the Fed says "We're done!" "Someone has to pay the price," Tunkel said. To alleviate the "regressive tax" of inflation on poorer households, the Fed aims to cool demand via a reverse wealth effect, diverting much of the pain to "people who have wealth, who have money in the market."

IN other words, us. I will note with our closing out of our First Round of REXIT trades left us UP 68% for the year so she is really talking about the other 75 million US stockholders.

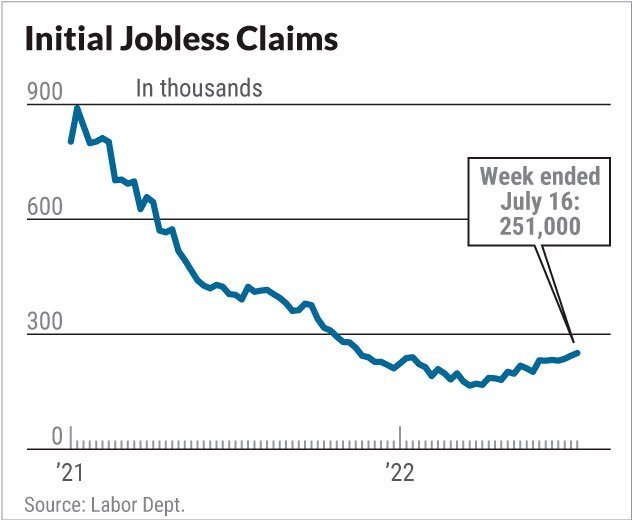

But let me be real--ALL the recent economic data has sent up no shortage of red flags. Initial jobless claims rose to 251,000 in the week of July 16. While historically low, claims have jumped about 50% from March lows.

Key Point: Some prior recessions have started after just a 20% rise in claims, notes Charles Schwab chief investment strategist Liz Ann Sonders.

Meanwhile, housing starts have plunged 14% over the past two months amid a spike in mortgage rates. Inflation-adjusted consumer spending fell 0.4% in May, more than erasing a 0.3% gain in April.

Then the Institute for Supply Management's manufacturing survey showed new orders suddenly turned negative in May and June.

And the Job Market: Weaker Than It Looks

Recall that the Labor Department's household survey showed that the ranks of the employed fell by 315,000 in June.

The survey shows 347,000 fewer people working than in March.

Key Point: The "household survey tends to lead (employer) payrolls around economic inflection points," Sonders wrote.

his looks like one of those times. An IBD analysis of Treasury inflows finds that the growth rate of federal income and employment taxes withheld from worker paychecks has been sliding sharply. Growth in those tax receipts over the 10 weeks through July 8 faded to just 7.5% from a year ago. That's down from about 12% through mid-May.

The tax data suggests that aggregate labor income — reflecting gains in wages, hiring, and incentive pay across the economy — has hit a NEGATIVE inflection point.

In short, labor income is now shrinking in real terms. Matt Trivisonno, who tracks tax withholdings for investors at DailyJobsUpdate.com to spot such inflection points, writes that he's also seeing "a nasty reversal" at odds with the supposedly strong job market.

Key Point: Trivisonno said he's "expecting the 372,000 jobs gained in June to be revised away in the future."

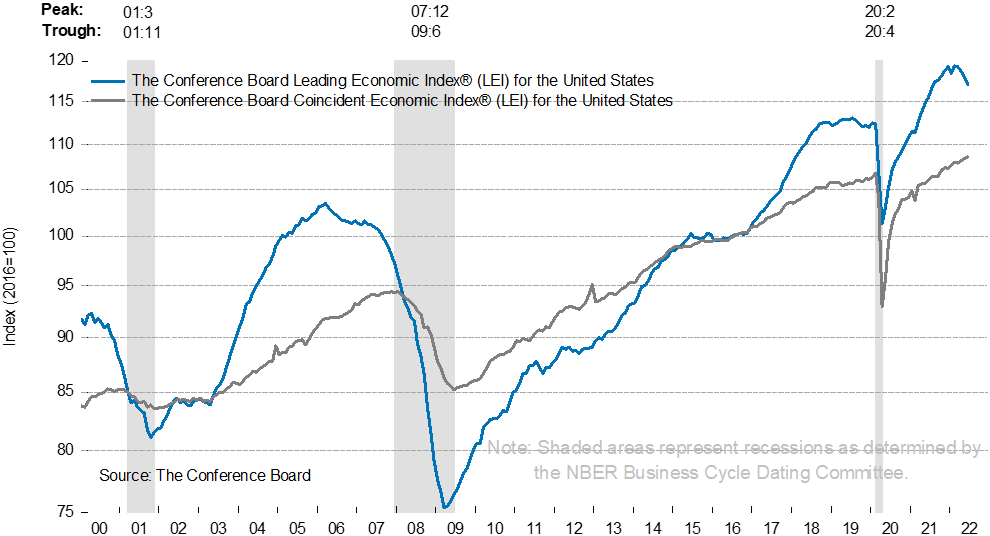

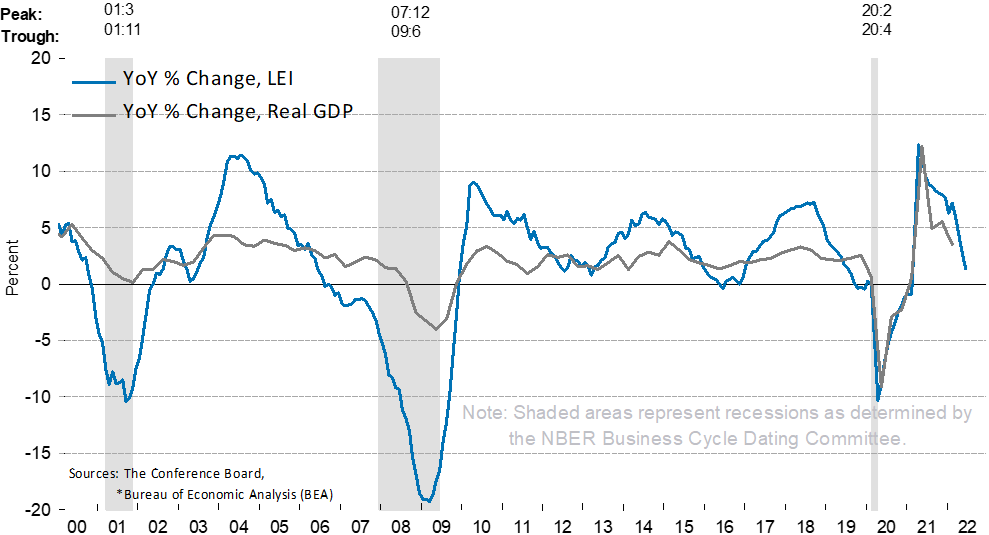

Now Let's Look at The KEY Leading (Not LAGGING) Economic Indicators

New York, July 21, 2022… The Conference Board Leading Economic Index® (LEI) for theU.S. decreased by 0.8 percent in June 2022 to 117.1 (2016=100), after declining by 0.6 percent in May. The LEI was down by 1.8 percent over the first half of 2022, a reversal from its 3.3 percent growth over the second half of 2021.

"The US LEI declined for a fourth consecutive month suggesting economic growth is likely to slow further in the near-term as recession risks grow,” said Ataman Ozyildirim, Senior Director of Economic Research at The Conference Board. “Consumer pessimism about future business conditions, moderating labor market conditions, falling stock prices, and weaker manufacturing new orders drove the LEI’s decline in June.

“Amid high inflation and rapidly tightening monetary policy, The Conference Board expects economic growth will continue to cool throughout 2022. A US recession around the end of this year and early next is now likely. Accordingly, we’ve downgraded our forecast of 2022 annual Real GDP growth to 1.7 percent year-over-year (from 2.3 percent), while 2023 growth was downgraded to 0.5 percent YOY (from 1.8 percent).”

US LEI appears to have peaked, pointing to a decline in economic activity in the near-term

Amid all the Federal Reserve recession talk as policymakers move aggressively to slay inflation, some on Wall Street still think Powell & Co. can nail a soft landing.

The price of oil and other commodities has already fallen sharply. That could turn modest declines in real spending into modest gains. If inflation comes down enough and the job market weakens just enough, the Fed may slow, then pause rate hikes later this year, the thinking goes. Expectations of a Fed pivot have sparked broad-based stock market gains this week.

Yet even in a soft-landing scenario, the near-term outlook for the stock market may not be particularly bullish.

"In our base case for a soft landing, we think stocks will be largely range-bound with continued elevated volatility as investors assess the durability of economic and corporate profit growth in the face of aggressive Fed rate hikes and declining real consumer incomes," wrote Solita Marcelli, chief investment officer Americas at UBS Global Wealth Management. "Historically, equity bear markets typically only end when the Fed starts to cut interest rates or the market begins to anticipate a re-acceleration in business activity and corporate profit growth. Both of these potential upside catalysts are unlikely to materialize in the near term."

Note: We will confirm this outlook in this week's earnings and guidance results.

S&P 500 Earnings Outlook

If the job market and inflation soften enough for Fed rate hikes to end early, what will that mean for corporate pricing power and profits? Morgan Stanley Chief Investment Officer Mike Wilson (for whom I read and generally agree with) sees the S&P 500 falling to 3,400 in a soft-landing scenario. He's betting that inflation will cool much more than expected amid lackluster demand. That suggests big earnings downgrades are on the way.

"Profits were inflated because of inflation. Now they're going to deflate, because we're going to have deflation in a lot of different areas," he told CNBC on July 12.

In Wilson's view, the counter-argument — that S&P 500 profits will hold up — implies that "inflation is going to stay hot and pricing power is going to remain robust." To Wilson, that seems unlikely "in an environment where we're already seeing demand destruction and consumer confidence is tanking."

BCA's Tunkel says analysts have yet to cut their estimates that S&P 500 earnings will rise about 10% over the next year. In her view, stocks could fall another 10% if EPS growth is cut to zero.

"Earnings will be the next casualty," Jefferies strategist Desh Peramunetilleke wrote this month. He noted that EPS has fallen an average 17% over the past 10 recessions.

S&P 500 Valuation Contraction

It's no coincidence that the S&P 500 hit at least a temporary bottom in mid-June, just as the 10-year Treasury yield was spiking close to 3.5%, a level last seen in 2011. To a large extent, the S&P 500's 24.5% decline from the peak to trough reflected a compression of valuations, as investors used a higher risk-free rate (the 10-year Treasury yield) to discount future earnings back to the present.

Our Recession 2022 Base Case: WE Still Have the Market Murderers Row of the Gale Force Headwinds AS we patiently wait for the final market PUKE (40+ VIX and Historically HIGH Weekly Volume)

With the Fed's Everything Bubble more than halfway to becoming fully demolished, the US and Global GDP and EPS Murderers Row of EPS killers are still pretty stunning when you add them all up (and we saw tonight with WalMart and Whirlpool)

1) The US, by our math, is ALREADY in a mild recession, as the July Atlanta GDP Now Index proves

2) Massive EU Central Bank tightening raises odds of EU recession to about 100%

3) A 250% higher cost of the capital based on the US prime lending rate

4) Salary and Wage spiral slowing but very sticky (wages and salaries ONLY come down in powerful recessions)

5) Layoffs start to bite in ALL the industries that OVER hired into the pandemic

6) General recession cost-cutting and lower UNIT sales volumes from HIGHer prices = LOWer margins (see Walmart)

7) Historically HIGH $dollar vs. Yen and EU and pound makes US exports and energy cost more

8) Repatriating foreign currency sales into $dollar cuts the gross margins

9) Discretionary durable goods sales fall as life essentials costs rise

10) Bottom 60% of US households ie <$65k gross income and 40% of households that do not own their home have no savings to fall back on and are now putting essential spending on credit cards

11) $16 TRILLION of wealth has now gone to money heaven (stocks, bonds, crypto and equity lost in homes purchased in the last 24 months) aka a MONSTER Negative Wealth Effect on discretionary spending by the top 70% of households ranked by income

12) The endless Ukraine war

BUT NOW we have added additional GDP drags/EPS drags to the list

16) Fed futures tell us the "Fed Put" aka stock market bailout is lowered to a 50% crash--30% is not enough

17) Retail bankruptcies are about to hit a perfect storm of higher inflation-based rent increases and hourly wage spiral

18) Reverse Wealth Effect: Many analysts now roughly calculate that every 10% decline in SP 500 plus 1% gain in 10 Year Treasuries = 1% LOWER GDP growth

19) NFIB surveys of small businesses say 72% have raised prices while their 6-month forward outlook for a stronger economy hit record lows

20) The spread between High Yield corporate bonds vs. US Treasuries has widened more than 2%, which is a leading indicator of rising default rates of lower-quality corporate debt

21) Apple--largest market-cap-weighted stock in SP 500-- is still at a 21 p/e or a 38% premium to the SP 500 stocks--and they only have 10% recurring revenues (i.e., vulnerable to consumer spending pullback + pandemic pull forward sales).

22) You don't micro-manage 8% inflation with a pick ax--you have to use a sledgehammer, and JayPow has promised to do just that until the inflation genie is back in the proverbial bottle

23) Coast to Coast’ Housing Correction Is Coming, Says Moody’s Chief Economist aka a Housing Bust with 6%+ mortgage rates ( Canada says they see a 25-35% housing crash from the Spring 2022 highs btw)

24) "Soft Landings Are a Myth When the Fed is Tightening 400bps into a Rapidly slowing economy, or as Larry Summers points out (who has been dead right on his inflation calls) "When you have unemployment UNDER 4% and inflation ABOVE 4% within 18-24 months recessions have ALWAYS 100% of the time occurred because the economy is going to HAVE TO create significant SLACK in unemployment and GDP growth to bring inflation down to acceptable levels.

25) US Industrial Output has downshifted sharply in May and June

26) Auto loan defaults and rental evictions spiked in Q2 2022

My Message to our subscribers and managed account clients?

1) No one calls the exact bottom of a bull market --but I have been on the record VERY CLOSE in 2003/2008 and, of course, April 2020 and the tech bear market June 10, 2022.

2) The magnitude of the multi-$trillion UNWIND of the Fed's historic QT/ZIRP/Everything Bubble era has to be highly correlated to the magnitude of the 12-year windup of the Everything Bubble era.

3) The $NDX and SPY are still in downtrends 50 week support lines still look like the profitable re-entry points

4) This bear market does NOT END until the Fed shows us they are done raising rates

5) And as noted above, Fed Funds rates HAVE TO go above the PCE inflation rate to create enough slack in demand

6) To give us ANOTHER historic opportunity to earn 200-300%+ returns on the economic recovery

NET NET, the path of least resistance is still DOWN for overall market indexes UNTIL FED STOPS HIKING RATES with rip-your-face-off short-covering rallies (which should be SOLD).